CONFIDENCE among Filipino consumers fell to a record low in the third quarter, while businesses were at their most pessimistic in over 11 years, as the pandemic took its toll on the economy, the latest surveys by the Bangko Sentral ng Pilipinas (BSP) showed.

Consumers’ current quarter confidence index (CI) dropped to -54.5%, the lowest since the nationwide survey started in the first quarter of 2007, according to the BSP.

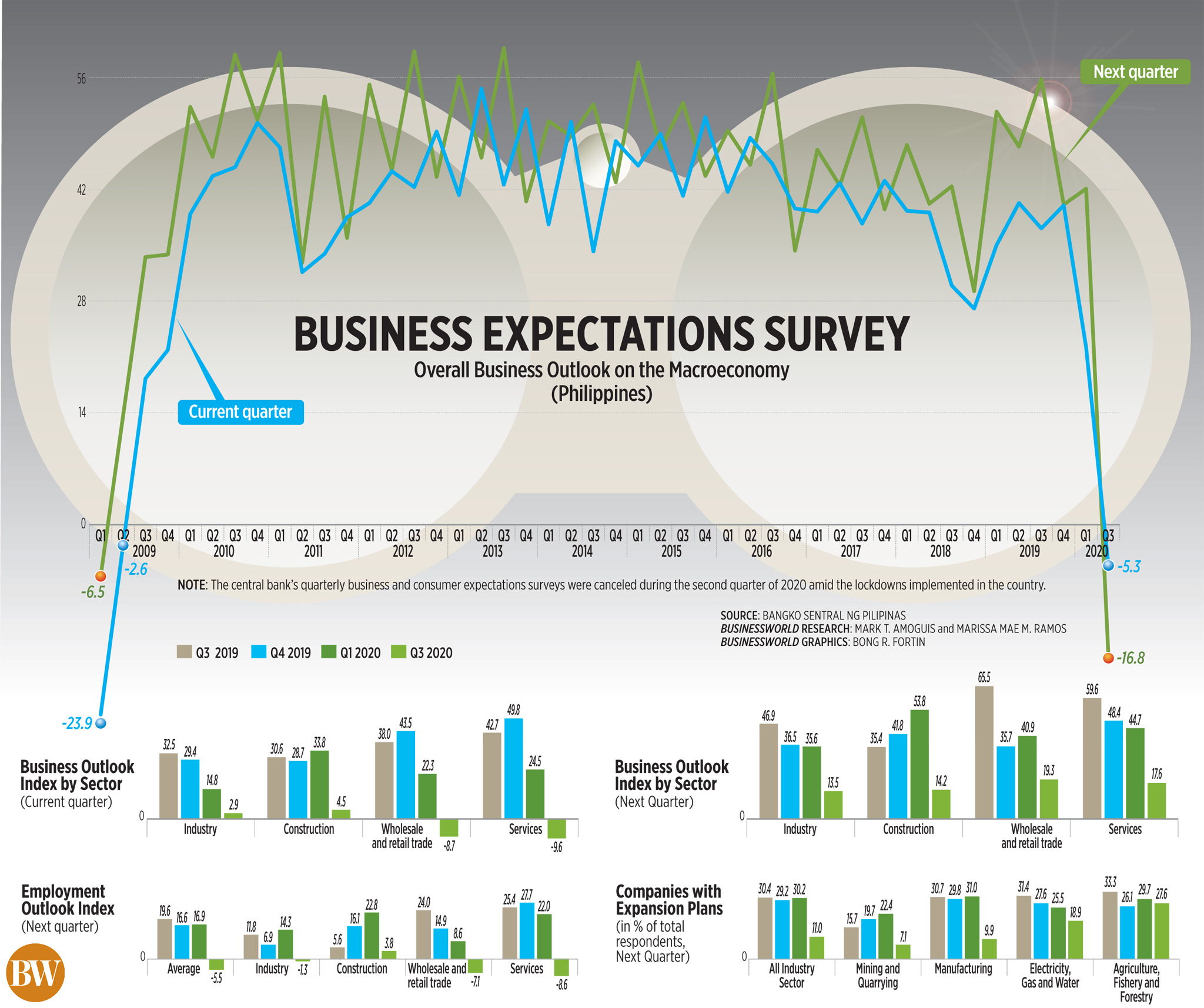

Business confidence also slid into negative territory at -5.3%, its lowest since the -23.9% logged in the first quarter of 2009 amid the global financial crisis.

The central bank did not conduct the survey in the second quarter due to the lockdown restrictions imposed to curb the spread of the coronavirus disease 2019 (COVID-19).

“[For consumers], the negative sentiment was attributed to COVID-19 pandemic. Other reasons cited by respondents were the following: high unemployment rate and less working family members, low and reduced income, and faster increase in the prices of goods,” BSP Department of Economic Statistics Director Redentor Paolo M. Alegre, Jr. said in an online briefing on Thursday.

Filipino consumers continue to be pessimistic for the fourth quarter, with the CI falling to negative territory at -4.1%. Their spending outlook also hit a record low to 26.4%, “indicating a contraction in consumer spending” during the holiday season.

However, consumers are more optimistic for the next 12 months with the CI at 25.5% against the 19.9% seen in the Q1 survey for the next 12 months.

“The consumer outlook was more upbeat for the next 12 months due to expectations of an end in the COVID-19 pandemic or return to normal as well as the consumers’ anticipation of the following: availability of more jobs; additional or high income, and stable prices of goods,” the BSP said.

SHAKY BUSINESS CONFIDENCE

Meanwhile, business confidence turned negative in the third quarter, as many companies were affected by the pandemic and economic slowdown.

“They noted a decrease in orders, sales and income, slowdown and temporary shutdown in business operations, and some concerns over government policies in dealing COVID-19,” Mr. Alegre said.

For the fourth quarter, business sentiment remained sluggish, with the CI falling to 16.8% against the 42.3% in the first quarter survey.

“Respondents’ less buoyant outlook for (fourth quarter 2020) was associated mainly with expectations of the continuing negative effects of the COVID-19 pandemic affecting the volume of orders, sales, and income, and overall economic activity, in general,” the BSP said.

“Similarly, business outlook on the country’s economy was less upbeat for the next 12 months as the CI declined to 37.5% from 55.8% in Q1 2020 survey results.”

The employment outlook index for the next quarter and the next 12 months were also grim at -5.5% and -2.1%, which could mean more layoffs in the coming months.

The business expectations survey was conducted from July 8 to Sept. 10 among 1,517 firms, while the consumer expectations survey covered 5,563 households from July 1-14. — Luz Wendy T. Noble