MOST BUSINESSES in the Philippines continued to feel the pain from the coronavirus disease 2019 (COVID-19) pandemic in July, even as the economy slowly reopened.

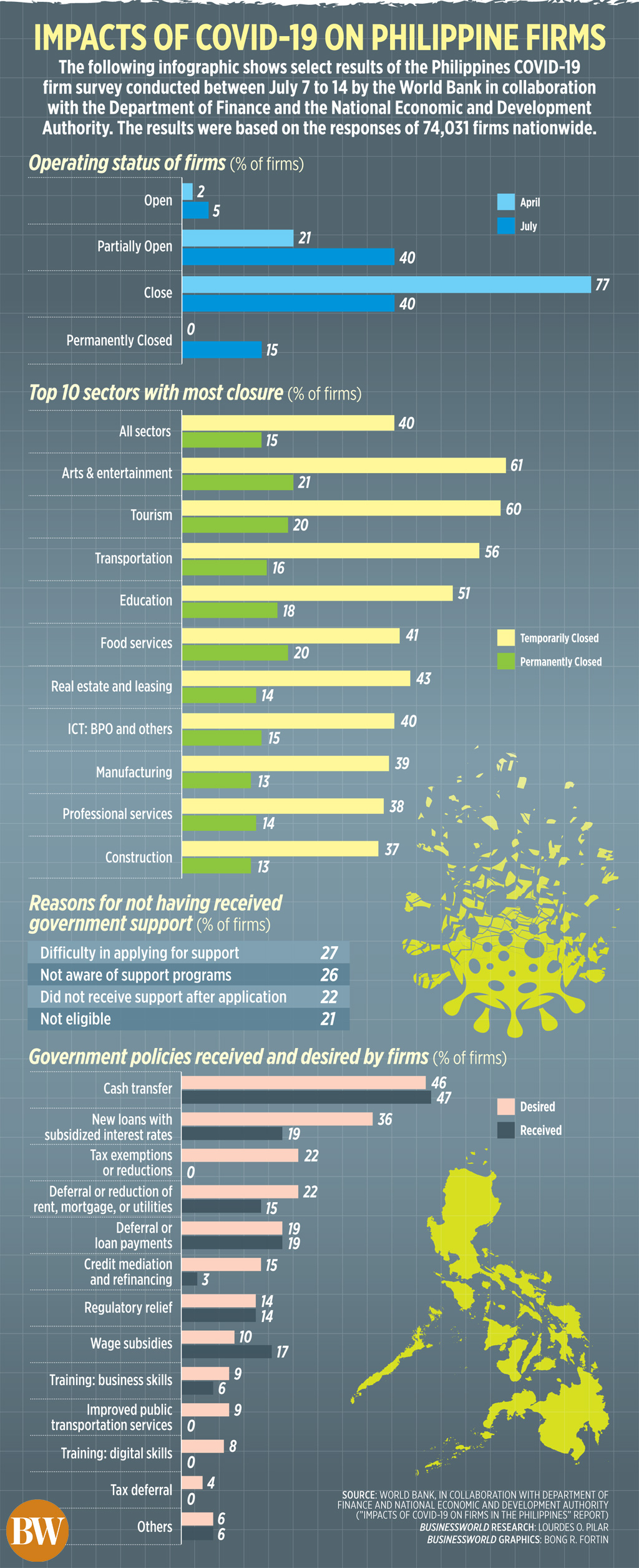

The survey conducted by the World Bank in collaboration with the Finance department and the National Economic and Development Authority (NEDA) from July 7-14 showed the extent of the impact of the coronavirus pandemic on operations of 74,031 companies around the country.

Four of 10 companies surveyed said they temporarily suspended operations in July, either voluntarily or by government mandate, while 15% said they had permanently shut down. While 45% were able to reopen, only 5% were operating at full capacity.

“The survey results indicate that the community quarantine had a significant temporary and permanent effect on the operational status of firms… There may be more (closures) considering that closed firms may not have responded to the survey,” the World Bank said.

Many companies were not allowed to operate in Luzon during the enhanced community quarantine from March 16 to April 30. The lockdown was extended until May 15 in Metro Manila, Central Luzon and other areas. In June, restrictions were further eased with regions either under a general or modified general community quarantine.

The survey showed the highest levels of closure in areas under an enhanced lockdown, with 70% of firms in Cebu and 57% of firms in the National Capital Region, Calabarzon and Central Luzon. One of five companies in the arts, entertainment and recreation sector, tourism, and food service sector, were permanently shut.

Even as restrictions eased, companies continued to see a sharp drop in sales. “The estimated loss of revenue is at 64% in July 2020 compared with April 2020, with 89% of firms reporting a reduction in sales,” the World Bank said.

One of three companies reported a drop in demand by more than 50%, mainly due to the restrictions in mobility that prevented customers from traveling to buy goods or services.

To deal with the crisis, businesses had to reduce costs by cutting hours of operations and jobs, as well as turning to digital solutions.

One of two companies surveyed said employee wages were reduced, while nearly half of the companies said they cut the number of employees. Education, food services and construction sectors saw the biggest job losses.

PESSIMISM PERSISTS

Most companies surveyed expressed a high degree of uncertainty and general pessimism about operations, sales and employees for the next three months.

“Even though community quarantine measures were relaxed to some extent during the time of the survey, firms still reported a high degree of uncertainty. Uncertainty is an important additional channel affecting firms during the pandemic, and as the economy reopens, this could result in a lower desire for risk-taking and additional investments,” the World Bank said.

About 45% of the closed companies said they did not know when they could reopen. Of those that were able to resume operations, 39% said they were unsure how long they can stay open, while 36% said they could remain open only for the next three months.

Uncertainty was highest among companies in the transportation, business process outsourcing (BPO), wholesale and retail trade, and rental and leasing sectors.

About a third of companies expect a decline in sales, while a fourth expect to trim their workforce.

“Such lack of confidence will likely limit additional investment and employment, restraining firms’ growth. These suggest that business activities are expected to stay subdued for an extended period,” the World Bank said.

On the other hand, 23% remained positive for a sales uptick, particularly those in the electronic manufacturing and utility sectors. Only 10% said they were considering hiring more workers.

“The survey indicates that policies are needed to support firms both in the short and long terms. The decrease in demand, as well as difficulties in financing cash shortfalls, has put many firms in a difficult position,” the World Bank said.

Companies said they would like to see the government implement measures to improve liquidity, such as “subsidized interest rates, cash transfers, deferral of loan, rent, or utility payments, and tax exemptions or reductions.”

The results of the World Bank survey were consistent with the latest consumer and business confidence surveys conducted by the Bangko Sentral ng Pilipinas (BSP).

Consumers’ current quarter confidence index (CI) dropped to -54.5%, the lowest since the nationwide survey started in the first quarter of 2007, according to the BSP.

Business confidence also slid into negative territory at -5.3%, its lowest since -23.9% in the first quarter of 2009 amid the global financial crisis. — B.M.Laforga