By Beatrice M. Laforga, Reporter

THE DEPARTMENT of Finance (DoF) is pressing Congress to pass the remaining two packages under its comprehensive tax reform program (CTRP), including improving real property valuation and assessment in the country, before President Rodrigo R. Duterte’s term ends.

In a statement, the DoF said it would push the passage of the remaining priority tax bills such as the proposed Real Property Valuation and Assessment Reform Act and Passive Income and Financial Intermediary Taxation Act.

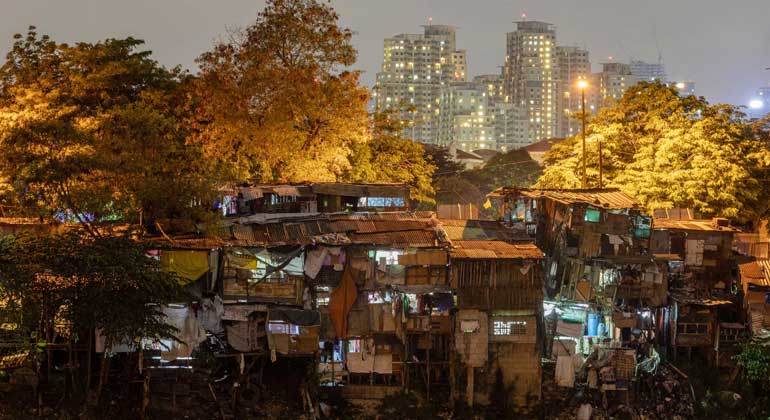

If passed, the first measure will establish a “single valuation base for taxation through the adoption of the schedule of market values of LGUs, and use the updated values as benchmark for other purposes, such as right-of-way acquisition, lease, rental, etc.”

The House of Representatives passed its version of the bill on third reading in November 2019, while the Senate version is still pending at the committee level.

The proposed passive income law, which aims to simplify the tax structure for financial instruments, was approved by the House in September 2019 but remains at the Senate committee level.

The government has less than two years to pass these two measures, as well as reforms on mining taxation and the Motor Vehicle Road Users’ Tax Act. Mr. Duterte will step down from office end-June 2022.

“As far as possible we want to finish all the CTRP packages,” Finance Assistant Secretary Maria Teresa S. Habitan said via Viber on Monday.

She said the DoF is also pushing for the passage of a bill that will reform the pension system of retired military and uniformed personnel, as well as the proposed Government Financial Institutions Unified Initiatives to Distressed Enterprises for Economic Recovery (GUIDE) Act.

The Bureau of the Treasury (BTr) has warned that the expected liabilities for the military could balloon to P9.6 trillion if the automatic indexing of pension levels with salaries of active-duty personnel was not halted. The suspension of indexing can bring the costs down to P3 trillion.

The DoF said it would support the passage of amendments to the Public Service Act and Retail Trade Liberalization Act; the Warehouse Receipts bill; and a law converting the Insurance Commission into a collegial body.

Albay Rep. Jose Maria Clemente S. Salceda said the House ways and means committee, which he heads, is set to tackle the remaining measures under the CTRP.

“I don’t believe this administration will have a lame duck phase, unlike other administrations. There is no let up in President Duterte’s popularity. Besides, we passed ‘sin’ taxes on tobacco in 2019 literally during the lame duck session of the 17th Congress. In short, don’t count the rest of tax reform out. I’m personally ready to go to bicam on both, anytime,” Mr. Salceda said in a Viber message on Sunday.

Meanwhile, Senate President Vicente C. Sotto III said senators are waiting for the Legislative Executive Development Advisory Council to brief them about the remaining CTRP measures.