By Luz Wendy T. Noble, Reporter

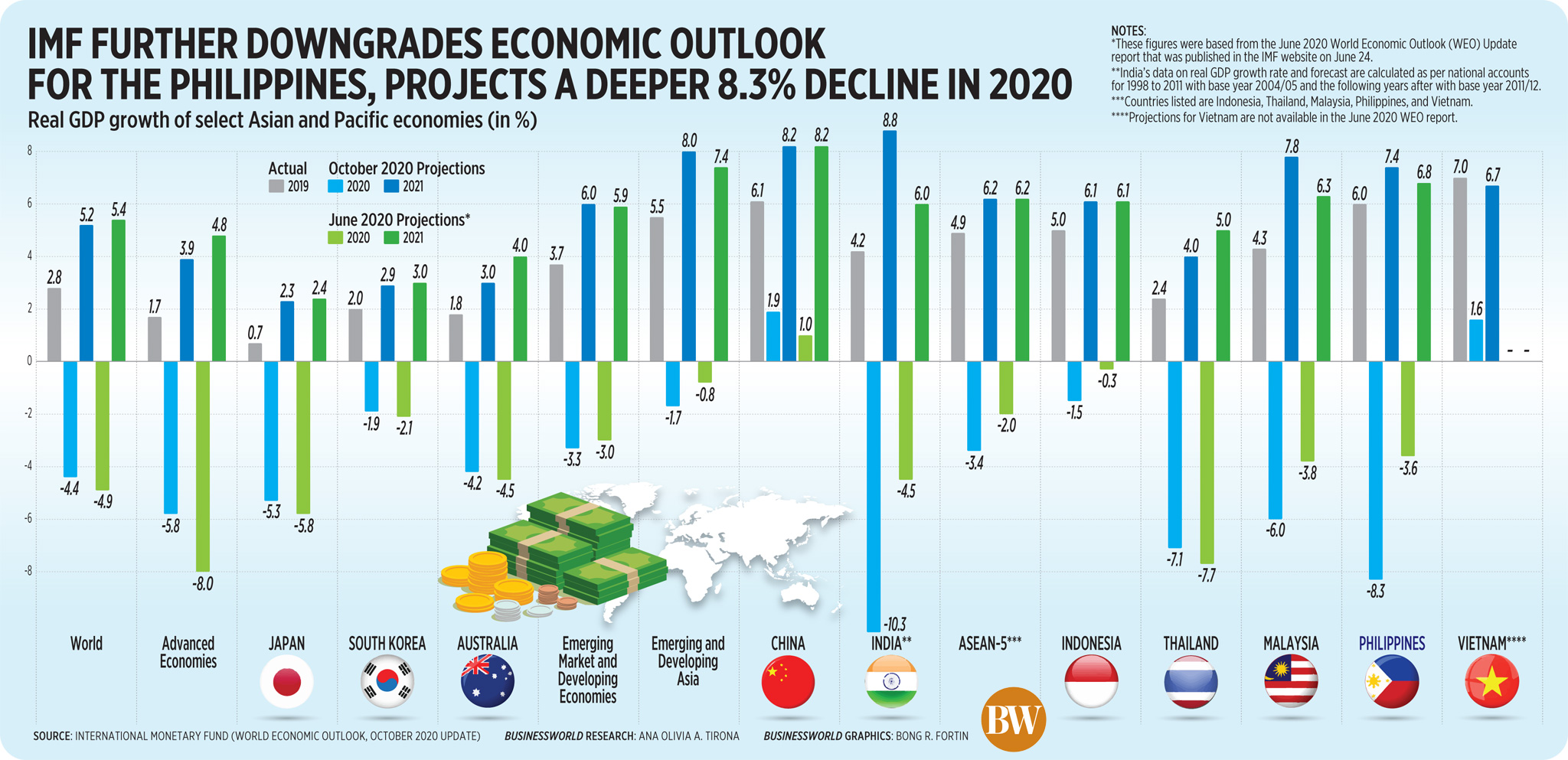

THE PHILIPPINES is likely to see the worst economic slide among Southeast Asian countries this year, after the International Monetary Fund (IMF) once again downgraded its contraction forecast for the country’s gross domestic product (GDP) to 8.3%.

In the latest World Economic Outlook (WEO) published on Tuesday, the multilateral lender said the global economy’s recovery prospects are likely to be “long, uneven, and uncertain,” with some emerging markets and developing economies continuing to see a rapid rise in coronavirus infections.

The IMF expects the global economy to shrink by 4.4% this year, slightly better than the 4.9% outlook it gave in June, citing some better-than-expected second-quarter GDP results in some advanced economies and indications of faster recovery in the third quarter.

For the Philippines, the IMF further slashed its 2020 GDP contraction forecast to 8.3% from 3.6% in June. The government earlier said the economy could shrink by 4.4 to 6.6% this year.

The country had the worst GDP outlook among the top five Association of Southeast Asian Nations (ASEAN) economies, lagging behind Thailand (-7.1%), Malaysia (-6%), and Indonesia (-1.5%). Only Vietnam is expected to post growth this year at 1.6%.

If realized, an 8.3% GDP slide would be the Philippines’ biggest full-year contraction on record based on the IMF’s purchasing power parity-adjusted gross domestic product (GDP) growth data dating back to 1980. The second-largest decline was in 1983 and 1984 when real GDP contracted by 7.3%.

“Despite a somewhat softer global contraction expected in the October WEO, weak public confidence and low remittances in the Philippines as a result of the pandemic are expected to continue weighing on private investment and consumption,” IMF Representative to the Philippines Yongzheng Yang told BusinessWorld in an e-mail.

“The negative impacts of COVID-19 are expected to be only partially offset by policy support,” he added.

Cash remittance inflows to the Philippines fell by 2.4% to $16.802 billion in the first seven months of 2020. The central bank expects cash remittance inflows to drop by 5% this year.

The Philippines has the highest number of COVID-19 cases in Southeast Asia at 344,713 as of Tuesday.

BOLD POLICIES NEEDED

The IMF sees the Philippine economy growing by 7.4% in 2021, faster than the 6.8% estimate given in June. This falls within the government’s 6.5% to 7.5% growth estimate for next year.

“This higher growth forecast is on account of — in addition to the 2020 base effect — an expected rebound in pent-up demand from the relaxation of quarantine measures and continued effects of the policy easing in 2020. Nonetheless, significant scarring effects (e.g., hysteresis, bankruptcies) are expected and it will take a couple of years before real GDP returns to the pre-pandemic (2019) level,” Mr. Yang said.

The IMF’s baseline projections assume social distancing will continue into 2021 until vaccine coverage expands and COVID-19 therapies improve.

In the medium term, Mr. Yang said the coronavirus crisis is “expected to result in lower levels of potential output and higher structural unemployment, but the Philippines’ real GDP growth is expected to converge back to potential of about 6.5% by 2025.”

Bold fiscal action will be needed to minimize the scars left by the pandemic, while recovery policy measures should be “forceful and well-calibrated,” Mr. Yang said.

“Owing to prudent debt management over the recent years, the Philippines has room to provide further fiscal support, if needed. To ensure an inclusive recovery, it is important to maintain accommodative macroeconomic policies during the recovery phase and continue pursuing structural reforms,” he added.

Mr. Yang also noted the asset quality of banks are expected to deteriorate, as borrowers face a loss of income. “The authorities will need to closely monitor the underlying vulnerabilities and prepare contingency plans, supported by reforms of resolution mechanisms,” he added.

From its earlier focus on income support, the Philippine government can shift fiscal policy to boost aggregate demand once sustainable recovery is ensured, Mr. Yang said. This could come in the form of a renewed infrastructure push in areas such as digitalization, healthcare and climate change.