By Beatrice M. Laforga, Reporter

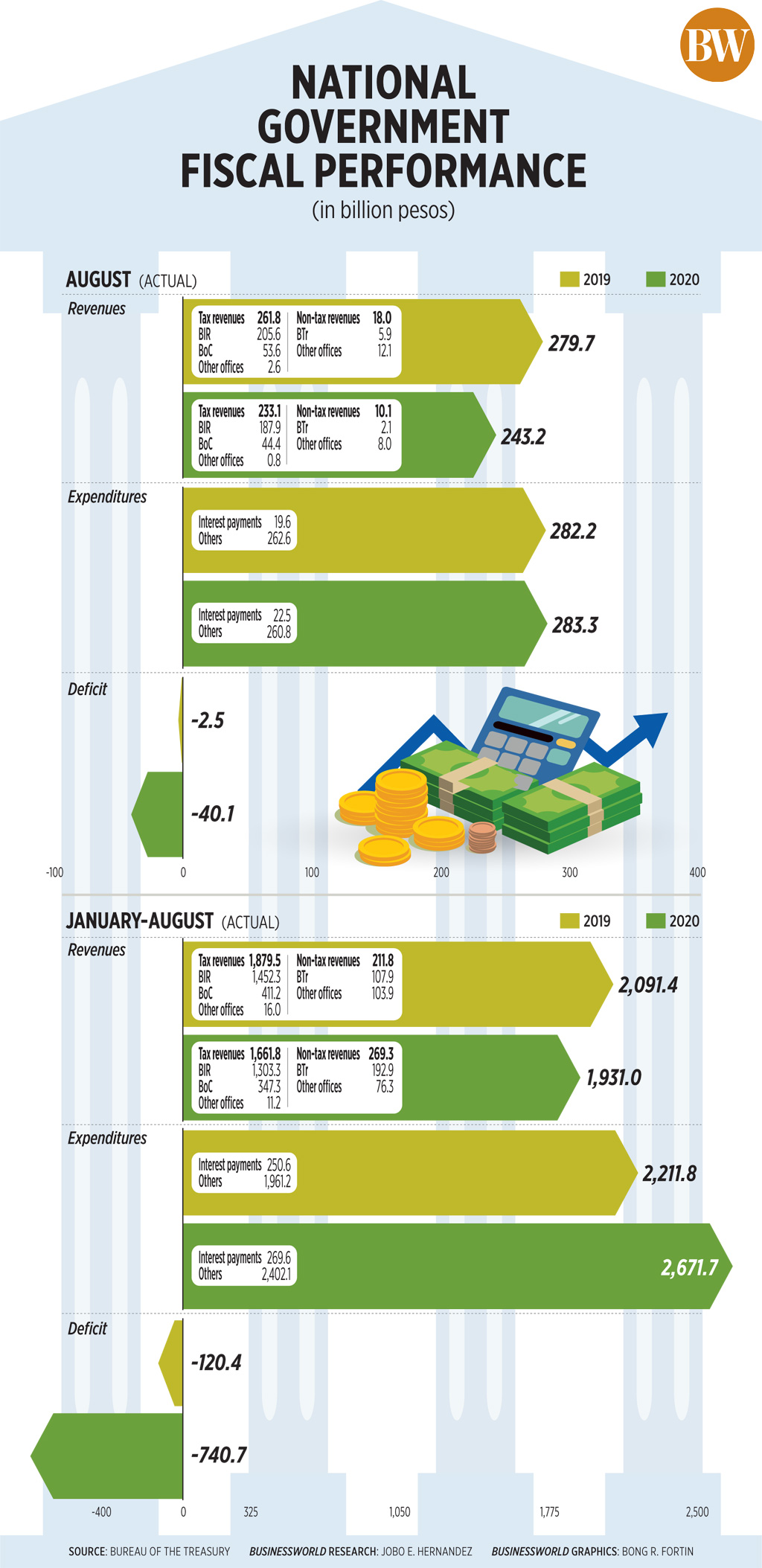

THE National Government’s budget deficit ballooned by 1,510% to P40 billion in August from a mere P2.5-billion shortfall a year ago, as revenues remained weak amid the economic slowdown, the Bureau of the Treasury (BTr) said.

The BTr cash operations report released Tuesday also showed the fiscal gap in August was slimmer than the P140.2-billion deficit in July.

Revenues slumped by 13% to P243.2 billion in August, as tax revenues dropped by 11% to P233.1 billion. Taxes collected by the Bureau of Internal Revenue (BIR) fell 9% to P187.9 billion, while the Bureau of Customs’ (BoC) collection was 17% lower at P44.4 billion.

Non-tax revenues, including privatization proceeds and fees and charges generated, slid by 44% to P10.1 billion in August.

The BTr’s income declined by 65% to P2.1 billion, which was attributed to a drop in remittances from Philippine Amusement and Gaming Corp. as well as lower government investments and deposits. Other non-tax revenues fell by 33% to P8 billion due to limited government transactions as offices observe health and safety protocols.

On the other hand, state spending inched up 0.38% to P283.3 billion in August, a slower pace than the 10% year-on-year uptick in July. This was attributed to the 15% rise in interest payments to P22.5 billion and the release of subsidies to the Philippine Health Insurance Corp. (PhilHealth) for the health insurance premiums of indigent beneficiaries under the National Health Insurance Program.

Overall spending was tempered by the 0.71% dip in primary spending that reached P260.8 billion.

The August tally brought the eight-month shortfall to P740.7 billion, surging by 515% from P120.4 billion logged a year ago. The fiscal gap was at P660.2 billion for 2019.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said the year-to-date deficit accounts for 3.9% of gross domestic product (GDP) and is expected to remain below 4% this year as revenues are seen to improve while the “government keeps a lid on spending.”

Economic managers project the deficit to hit 9.6% of GDP by yearend.

In the eight months to August, overall spending climbed 21% to P2.671 trillion, on the back of the 22% rise in primary expenditures which reached P2.402 trillion. Interest payments also grew 8% to P269.6 billion.

As a share of expenditures, the Treasury said interest payments level declined to 10.09% as of August from 11.33% in the same period last year.

However, interest payments as a percentage of revenues inched up to 13.96% from 11.98% the year prior because of weak revenue collections.

Eight-month revenues slipped 8% to P1.931 trillion, dragged by the 12% decline in tax collections to P1.661 trillion. The BIR’s tax take dipped by 10% to P1.303 trillion, while the BoC’s collections dropped by 16% to P347.3 billion.

The Treasury said the BIR has so far collected 77% of its downward-revised P1.685 trillion target for the year. However, this is still just over half of the P2.576-trillion pre-pandemic goal. Customs’ eight-month revenues accounted for 69% of its revised goal.

“BIR needs a monthly average collection of P96 billion for the rest of the year to reach its revised full-year program. BoC has still to collect P158.9 billion, or P40 billion on average per month, to achieve its revised P506.2 billion program,” it said.

Finance Secretary Carlos G. Dominguez III told lawmakers on Wednesday that the country’s two biggest revenue agencies are confident they will be able to meet their reduced targets for the year despite the pandemic.

“If there’s anything that this COVID-19 pandemic did is to inject a large amount of uncertainty but I believe the new revised targets will be met by the end of this year,” he said.

The BIR and BoC exceeding their targets in the past two months and Metro Manila’s return to a modified enhanced community quarantine (MECQ) for two weeks has helped slim the deficit last month, said Robert Dan J. Roces, chief economist at Security Bank Corp.

“We do expect, however, that the deficit may be wider moving forward as government spending should begin to pick up over the course of the next few months, with the government — possessing enough fiscal leeway — filling the need to increase expenditures to help with growth momentum even as revenues remain stagnant with the economy in recession,” Mr. Roces said in a Viber message Wednesday.

The further reopening of the economy could give tax collections a boost in the coming months, UnionBank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said.

“Barring any virus flare up that will cause further large-scale containment, like what is happening in the United Kingdom and other advanced countries, government revenues can be expected to steadily rise,” he said.