S&P GLOBAL RATINGS expects the Philippine economy to shrink by 9.5% this year — the worst in Southeast Asia, due to the “stubbornly high” coronavirus disease 2019 (COVID-19) infections and low fiscal support.

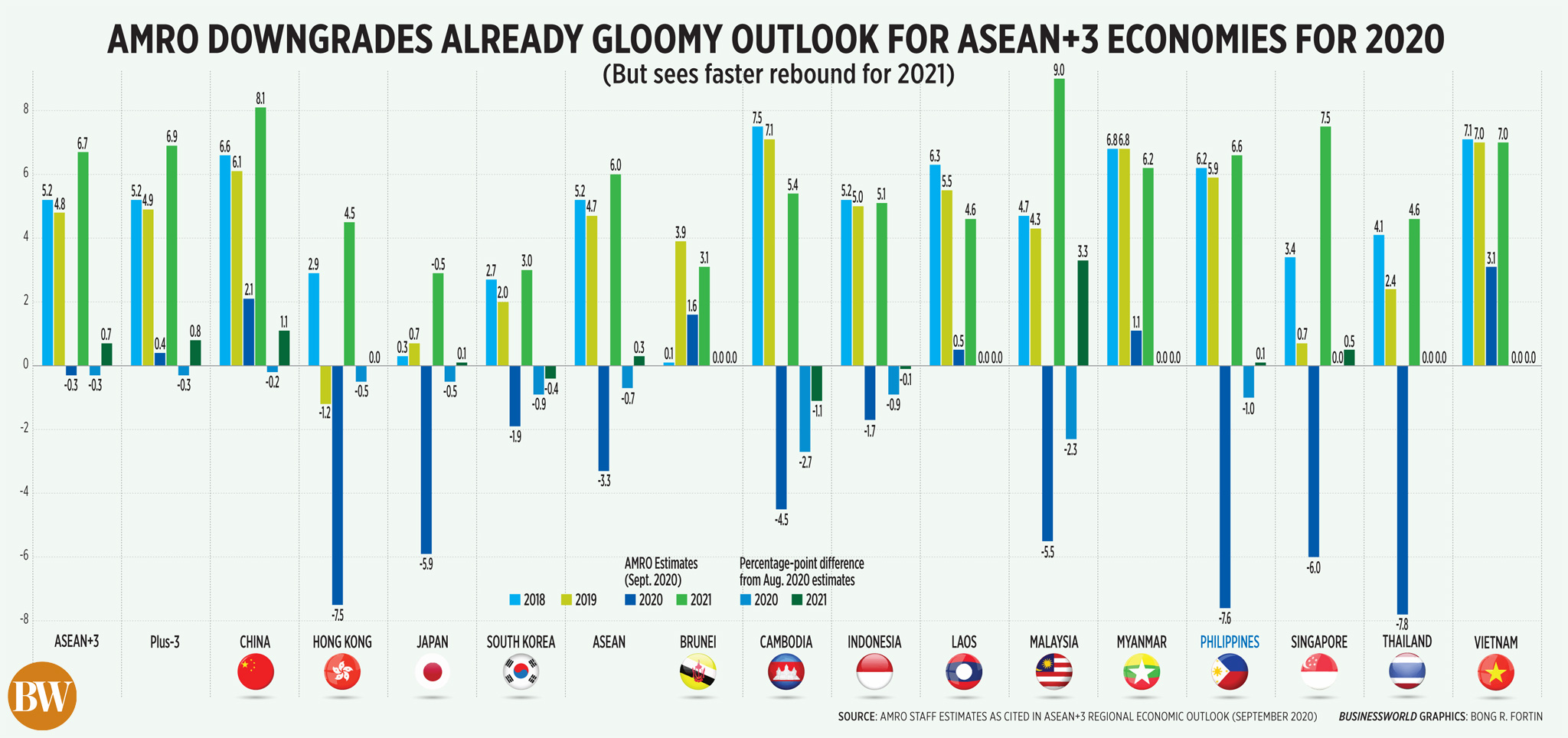

At the same time, the ASEAN+3 Macroeconomic Research Office (AMRO) revised its Philippine gross domestic product (GDP) forecast to -7.6% this year, although this is only the second worst in the region following Thailand.

Both S&P and AMRO’s projections are worse than the government’s -4.5% to -6.6% outlook for this year.

“We revise our 2020 growth forecast to -9.5% (previously -3%) with minimal changes to subsequent years, implying a larger permanent loss in output,” S&P said in a report released on Thursday.

The debt watcher’s outlook for the Philippine economy is the lowest among the 14 economies in its report, followed by India’s -9%. Other Southeast Asian countries are seen to fare better such as Thailand and Hong Kong (-7.2%), Singapore (-5.8%), Malaysia (-5%) and Indonesia (-1.1%). Only Vietnam (1.9%) is expected to see growth among Southeast Asian economies.

“Renewed lockdowns from August in major metropolitan areas, including Metro Manila, together with lingering household caution amid stubbornly high COVID-19 infection rates and limited fiscal policy support are suppressing consumer spending and resulting in widespread job losses,” S&P said.

As of Thursday, total confirmed COVID-19 cases in the Philippines stood at 296,755, still the highest in Southeast Asia.

President Rodrigo R. Duterte earlier this month signed the Bayanihan to Recover as One Act, touted as a P165.5-billion stimulus package. It is the sequel to Bayanihan I which allocated P275 billion for the pandemic response in March.

S&P expects the Philippine economy to bounce back with a 9.6% growth in 2021, faster than its earlier 9.4% estimate.

“However, we expect permanent damage to corporate sector balance sheets and the labor market, which will leave (gross domestic product) well short of where it would likely have been in the absence of COVID,” it said.

S&P said it is still pricing in two more rate cuts from the Bangko Sentral ng Pilipinas this year before it goes for a “fairly long pause.”

The central bank will have three more policy setting reviews this year falling on Oct. 1, Nov. 19, and Dec. 17. The Monetary Board has so far slashed rates by a total of 175 basis points this year, bringing down the reverse repurchase, lending, and deposit rates to record lows of 2.25%, 2.75%, and 1.75%, respectively.

For Asia-Pacific, S&P expects the region’s economies to shrink by 2% in 2020 and grow by 6.9% next year, which would still be 5% lower than pre-COVID trend by end-2021. China will lead the region’s “uneven recovery,” with 2.1% GDP growth this year.

“The pandemic is not over but the worst of its economic impact has passed. Governments are adopting more targeted strategies for flattening COVID-19 curves, with less recourse to nationwide lockdowns. Households are spending again on services as well as goods,” Shaun Roache, Asia-Pacific chief economist for S&P Global Ratings, said in a statement.

Meanwhile, AMRO’s latest -7.6% projection for the Philippines (from -6.6% in August) is the second steepest slump projected among ASEAN+3 economies, after Thailand (-7.8%).

“The downgrade of growth forecast for 2020 mainly reflects the impact from the reimposition of the lockdown measures since early August,” Zhiwen Jiao, AMRO’s country economist for the Philippines, said in an e-mail.

AMRO also sees the Philippine economy to grow by 6.6% in 2021, although the recovery to bring back GDP to its pre-pandemic level may take until 2022.

“Going forward, the trajectory and pace of the recovery will hinge on the development of the COVID-19 pandemic, the recovery of global economy and policy responses,” Mr. Jiao said.

AMRO said it expects the ASEAN region to contract by 3.3% this year before rebounding to 6% in 2021. — Luz Wendy T. Noble and Beatrice M. Laforga